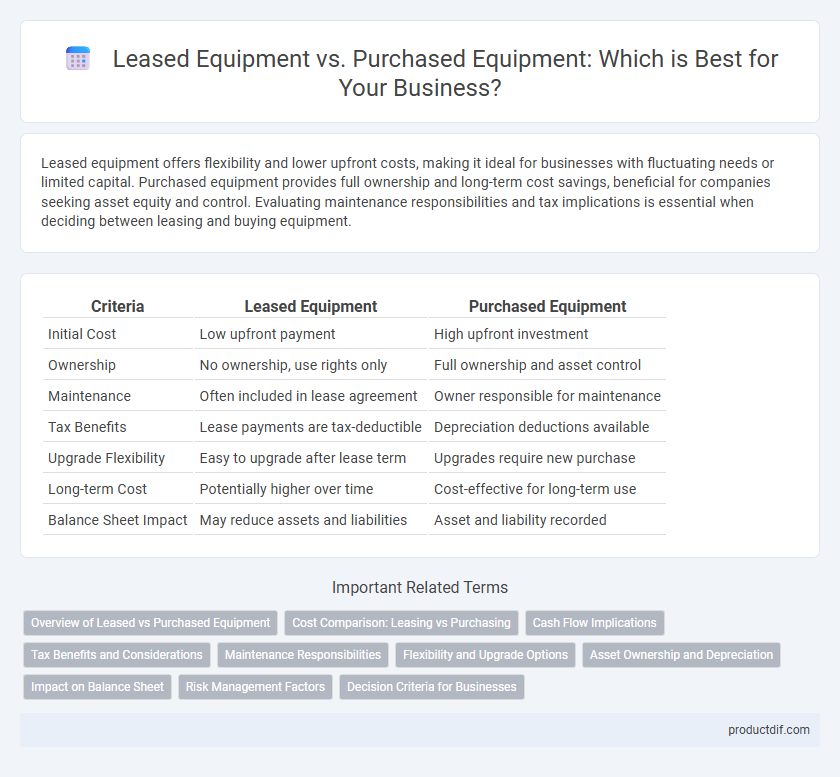

Leased equipment offers flexibility and lower upfront costs, making it ideal for businesses with fluctuating needs or limited capital. Purchased equipment provides full ownership and long-term cost savings, beneficial for companies seeking asset equity and control. Evaluating maintenance responsibilities and tax implications is essential when deciding between leasing and buying equipment.

Table of Comparison

| Criteria | Leased Equipment | Purchased Equipment |

|---|---|---|

| Initial Cost | Low upfront payment | High upfront investment |

| Ownership | No ownership, use rights only | Full ownership and asset control |

| Maintenance | Often included in lease agreement | Owner responsible for maintenance |

| Tax Benefits | Lease payments are tax-deductible | Depreciation deductions available |

| Upgrade Flexibility | Easy to upgrade after lease term | Upgrades require new purchase |

| Long-term Cost | Potentially higher over time | Cost-effective for long-term use |

| Balance Sheet Impact | May reduce assets and liabilities | Asset and liability recorded |

Overview of Leased vs Purchased Equipment

Leased equipment offers flexibility with lower upfront costs, ideal for businesses requiring short-term use or frequent upgrades. Purchased equipment provides full ownership, enabling long-term asset value and potential tax advantages such as depreciation. Evaluating factors like budget constraints, usage duration, and maintenance responsibilities helps determine the optimal choice between leased and purchased equipment.

Cost Comparison: Leasing vs Purchasing

Leased equipment typically involves lower upfront costs and predictable monthly payments, making it a cost-effective option for businesses with limited capital or short-term needs. Purchased equipment requires a higher initial investment but offers long-term asset ownership, potential tax benefits like depreciation, and no recurring lease fees. Evaluating the total cost of ownership, including maintenance, financing, and resale value, is essential for determining the most economical choice between leasing and purchasing equipment.

Cash Flow Implications

Leased equipment preserves cash flow by requiring smaller, regular payments instead of a large upfront cost, which benefits businesses managing working capital. Purchased equipment demands a significant initial outlay, potentially straining cash flow but resulting in ownership assets and depreciation benefits. Evaluating cash flow implications hinges on the business's liquidity needs, tax strategy, and long-term financial goals.

Tax Benefits and Considerations

Leased equipment often provides tax benefits by allowing businesses to deduct lease payments as operating expenses, reducing taxable income without the upfront capital outlay required for purchased equipment. Purchased equipment can be depreciated over its useful life using methods like Section 179 or bonus depreciation, potentially creating significant tax deductions but requiring larger initial investment. Businesses must weigh immediate cash flow advantages of leasing against long-term tax depreciation benefits and asset ownership when deciding between leased and purchased equipment.

Maintenance Responsibilities

Leased equipment maintenance responsibilities typically fall on the lessor, reducing the lessee's operational costs and ensuring timely repairs through professional service agreements. In contrast, purchased equipment requires the owner to manage and finance all maintenance tasks, which can increase long-term expenses but offer greater control over service schedules and customization. Understanding these differences aids businesses in optimizing asset management strategies and budgeting for equipment lifecycle costs.

Flexibility and Upgrade Options

Leased equipment offers greater flexibility by allowing businesses to upgrade or switch to newer models without long-term commitments, adapting quickly to changing technology needs. Purchased equipment requires a larger upfront investment and limits upgrade options, often leading to outdated assets over time. Leasing enables companies to maintain cutting-edge tools while managing cash flow more effectively.

Asset Ownership and Depreciation

Leased equipment remains the property of the lessor, with the lessee recording lease payments as operational expenses, while purchased equipment becomes a capital asset subject to depreciation on the balance sheet. Ownership of purchased equipment allows companies to claim depreciation deductions over the asset's useful life, directly impacting taxable income. In contrast, leased equipment does not generate depreciation for the lessee but offers flexibility without tying up capital in fixed assets.

Impact on Balance Sheet

Leased equipment typically appears as a right-of-use asset with a corresponding lease liability on the balance sheet, affecting both assets and liabilities without outright ownership. Purchased equipment is recorded as a fixed asset at cost, subject to depreciation, and may increase equity through retained earnings. The choice between leasing and purchasing impacts financial ratios, asset turnover, and debt covenants differently, influencing analysts' evaluation of company solvency and operational efficiency.

Risk Management Factors

Leased equipment reduces upfront capital expenditure but introduces risks related to contract terms, maintenance obligations, and potential penalties for early termination, impacting operational flexibility. Purchased equipment entails higher initial costs and depreciation risks but offers full control over asset usage, customization, and disposal, which can enhance long-term risk mitigation strategies. Effective risk management involves analyzing asset lifecycle costs, usage intensity, and residual value to determine the optimal balance between leased and owned equipment.

Decision Criteria for Businesses

Businesses deciding between leased equipment and purchased equipment should evaluate factors such as cash flow impact, asset ownership, and tax implications. Leasing often provides lower upfront costs and flexibility for technology upgrades, while purchasing builds equity and may offer tax depreciation benefits. The decision depends on business size, financial strategy, equipment usage duration, and maintenance responsibilities.

Leased equipment vs purchased equipment Infographic

productdif.com

productdif.com