Capital equipment refers to long-term assets like machinery and vehicles used to produce goods or services, whereas operating equipment includes items essential for daily operations, such as tools and supplies. Investing in capital equipment typically involves significant upfront costs with depreciation over time, while operating equipment expenses are usually smaller and incurred regularly. Understanding the distinction helps businesses allocate budgets effectively and optimize operational efficiency.

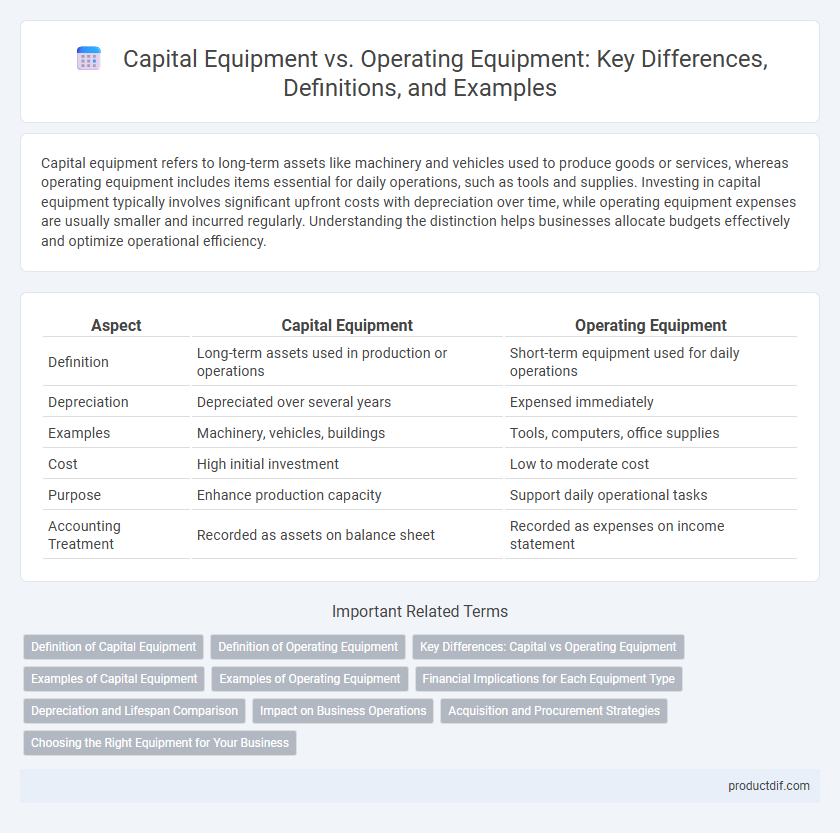

Table of Comparison

| Aspect | Capital Equipment | Operating Equipment |

|---|---|---|

| Definition | Long-term assets used in production or operations | Short-term equipment used for daily operations |

| Depreciation | Depreciated over several years | Expensed immediately |

| Examples | Machinery, vehicles, buildings | Tools, computers, office supplies |

| Cost | High initial investment | Low to moderate cost |

| Purpose | Enhance production capacity | Support daily operational tasks |

| Accounting Treatment | Recorded as assets on balance sheet | Recorded as expenses on income statement |

Definition of Capital Equipment

Capital equipment refers to long-term physical assets used in the production of goods and services, including machinery, vehicles, and buildings, which are depreciated over time. These assets are distinguished from operating equipment, which encompasses short-term tools and supplies used daily in operations. Capital equipment investments enhance production capacity and operational efficiency, representing significant expenditure on fixed assets.

Definition of Operating Equipment

Operating equipment refers to the tools and machinery used daily in production processes to support operational activities. It typically includes items such as computers, forklifts, and conveyor belts that facilitate ongoing business functions but do not constitute long-term investments. Unlike capital equipment, operating equipment usually has a shorter depreciation period and is essential for maintaining continuous workflow.

Key Differences: Capital vs Operating Equipment

Capital equipment refers to long-term assets like machinery and buildings that are used over multiple fiscal periods to generate value, while operating equipment encompasses short-term tools and supplies necessary for daily business functions. Capital equipment involves significant investment and depreciation over time, whereas operating equipment typically incurs immediate expense and frequent replacement. Understanding these distinctions aids in accurate financial reporting and strategic budgeting decisions.

Examples of Capital Equipment

Capital equipment encompasses high-value, long-term assets such as industrial machinery, manufacturing robots, and large-scale construction vehicles essential for production processes. These assets are characterized by their durability and significant role in generating revenue over multiple years. Unlike operating equipment, capital equipment typically requires substantial initial investment and depreciation over time.

Examples of Operating Equipment

Operating equipment includes machinery and tools used daily in the production process, such as conveyor belts, packaging machines, and forklifts. These assets typically have shorter lifespans and are expensed through operational costs rather than capitalized. Examples like welding machines, computers for manufacturing control, and hand tools underscore their role in supporting ongoing operations.

Financial Implications for Each Equipment Type

Capital equipment involves significant upfront investment and is recorded as an asset on the balance sheet, leading to depreciation expenses over time that impact tax liabilities and cash flow management. Operating equipment, classified as operational expenses, affects the income statement directly through immediate costs, influencing short-term profitability and budgeting flexibility. Understanding these financial implications aids businesses in optimizing asset allocation and managing both long-term investments and ongoing operational costs effectively.

Depreciation and Lifespan Comparison

Capital equipment typically has a longer lifespan, often exceeding five years, and depreciates over time using methods such as straight-line or declining balance depreciation, reflecting its extended use and value. Operating equipment usually has a shorter lifespan, often less than five years, with faster depreciation schedules to account for more frequent replacements and higher wear and tear. The choice between capital and operating equipment impacts financial statements, asset management, and tax reporting due to differing depreciation rates and asset longevity.

Impact on Business Operations

Capital equipment represents long-term investments like machinery or technology that enhance production capacity and efficiency, directly impacting business scalability and asset value. Operating equipment includes tools and devices used daily for routine tasks, influencing operational continuity and maintenance costs. Efficient management of both types ensures optimized workflow, cost control, and sustainable growth.

Acquisition and Procurement Strategies

Capital equipment acquisition strategies emphasize long-term investment value, focusing on durability, technology integration, and lifecycle costs to optimize procurement budgets. Operating equipment procurement prioritizes flexibility, rapid deployment, and cost-efficiency, enabling efficient day-to-day operations with frequent maintenance cycles. Strategic sourcing for both equipment types involves comprehensive vendor evaluation, contract negotiation, and alignment with organizational asset management plans.

Choosing the Right Equipment for Your Business

Selecting the right equipment for your business hinges on understanding the distinction between capital equipment, which involves significant upfront investment and long-term asset value, and operating equipment, typically smaller tools or devices used in day-to-day operations. Capital equipment, such as machinery or production lines, impacts your balance sheet and requires thorough cost-benefit analysis and depreciation planning. Evaluating operational needs, financial capacity, and maintenance costs ensures optimal alignment with business objectives and enhances overall efficiency.

Capital Equipment vs Operating Equipment Infographic

productdif.com

productdif.com