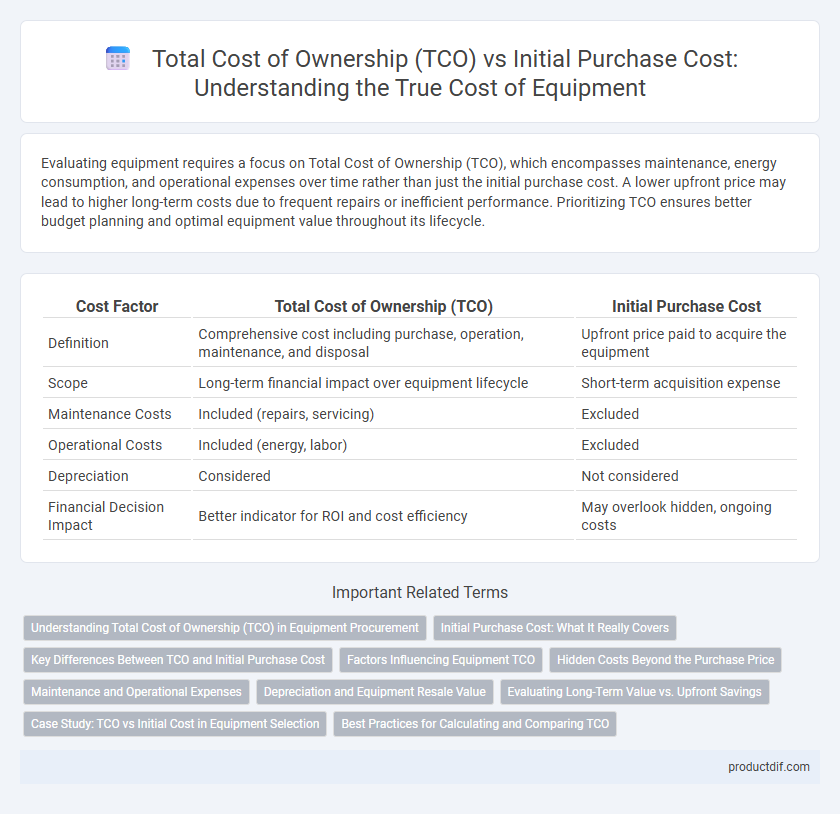

Evaluating equipment requires a focus on Total Cost of Ownership (TCO), which encompasses maintenance, energy consumption, and operational expenses over time rather than just the initial purchase cost. A lower upfront price may lead to higher long-term costs due to frequent repairs or inefficient performance. Prioritizing TCO ensures better budget planning and optimal equipment value throughout its lifecycle.

Table of Comparison

| Cost Factor | Total Cost of Ownership (TCO) | Initial Purchase Cost |

|---|---|---|

| Definition | Comprehensive cost including purchase, operation, maintenance, and disposal | Upfront price paid to acquire the equipment |

| Scope | Long-term financial impact over equipment lifecycle | Short-term acquisition expense |

| Maintenance Costs | Included (repairs, servicing) | Excluded |

| Operational Costs | Included (energy, labor) | Excluded |

| Depreciation | Considered | Not considered |

| Financial Decision Impact | Better indicator for ROI and cost efficiency | May overlook hidden, ongoing costs |

Understanding Total Cost of Ownership (TCO) in Equipment Procurement

Total Cost of Ownership (TCO) in equipment procurement encompasses not only the initial purchase cost but also expenses related to installation, maintenance, operation, and disposal. Accurately assessing TCO allows businesses to make informed decisions by revealing the long-term financial impact of equipment investments, including energy consumption, repair frequency, and downtime costs. Prioritizing TCO over upfront price ensures procurement strategies that optimize budget allocation, enhance asset longevity, and reduce unforeseen operational expenditures.

Initial Purchase Cost: What It Really Covers

Initial Purchase Cost primarily covers the upfront price of acquiring equipment, including manufacturing, shipping, and basic installation fees. It often excludes ongoing expenses such as maintenance, energy consumption, repairs, and eventual disposal costs. Understanding that Initial Purchase Cost is just one component of Total Cost of Ownership (TCO) helps in making more informed long-term investment decisions.

Key Differences Between TCO and Initial Purchase Cost

Total Cost of Ownership (TCO) includes all expenses related to equipment, such as maintenance, operation, depreciation, and downtime, while Initial Purchase Cost only covers the upfront price of acquiring the equipment. TCO provides a comprehensive view of long-term financial impact, helping businesses evaluate true affordability beyond the sticker price. Emphasizing TCO can prevent costly surprises by factoring in hidden costs often overlooked when focusing solely on initial purchase cost.

Factors Influencing Equipment TCO

Equipment Total Cost of Ownership (TCO) extends beyond the initial purchase price to include expenses such as maintenance, energy consumption, and downtime costs. Key factors influencing TCO are the equipment's durability, frequency of repairs, and operational efficiency, which directly impact long-term financial performance. Understanding these variables enables better decision-making by highlighting hidden costs that affect overall profitability.

Hidden Costs Beyond the Purchase Price

Total Cost of Ownership (TCO) encompasses not only the initial purchase price of equipment but also hidden costs such as maintenance, repairs, energy consumption, training, and downtime. These expenses can significantly increase the overall investment required, impacting budget forecasts and procurement strategies. Evaluating TCO provides a more accurate financial picture, ensuring long-term value and operational efficiency beyond the upfront cost.

Maintenance and Operational Expenses

Total Cost of Ownership (TCO) for equipment extends beyond the initial purchase price, encompassing significant maintenance and operational expenses that can surpass upfront costs over the asset's lifecycle. Routine maintenance, spare parts, energy consumption, and downtime impact overall expenditures, emphasizing the need for a comprehensive TCO analysis to achieve cost-effective asset management. Evaluating TCO provides clearer insights into equipment efficiency, budget forecasting, and long-term financial planning compared to assessing initial costs alone.

Depreciation and Equipment Resale Value

Total Cost of Ownership (TCO) incorporates depreciation and equipment resale value, providing a comprehensive financial perspective beyond the initial purchase cost. Depreciation reflects the equipment's loss in value over time, significantly impacting long-term expenses and tax considerations. High resale value can offset depreciation effects, reducing the overall TCO and improving return on investment for equipment buyers.

Evaluating Long-Term Value vs. Upfront Savings

Evaluating Total Cost of Ownership (TCO) reveals that long-term expenses such as maintenance, energy consumption, and depreciation often exceed initial purchase costs for equipment. Prioritizing TCO over upfront savings ensures better financial planning, reduced downtime, and enhanced operational efficiency. This approach allows businesses to invest in higher-quality equipment that delivers greater value and reliability over its entire lifecycle.

Case Study: TCO vs Initial Cost in Equipment Selection

A detailed case study comparing Total Cost of Ownership (TCO) and initial purchase cost in equipment selection reveals that lower upfront expenses often lead to higher long-term operational and maintenance costs. Equipment with higher initial investments typically offers better energy efficiency, durability, and reduced downtime, significantly lowering TCO. This analysis emphasizes the importance of evaluating lifecycle expenses rather than focusing solely on initial cost to optimize investment decisions.

Best Practices for Calculating and Comparing TCO

Accurately calculating Total Cost of Ownership (TCO) involves considering not just the initial purchase cost but also ongoing expenses like maintenance, energy consumption, downtime, and disposal costs. Best practices include gathering detailed data on lifecycle expenses, applying standardized cost models, and incorporating usage patterns to ensure a comprehensive comparison between equipment options. Comparing TCO rather than upfront price enables more informed investment decisions, driving long-term savings and operational efficiency.

Total Cost of Ownership (TCO) vs Initial Purchase Cost Infographic

productdif.com

productdif.com