CapEx (Capital Expenditures) refers to the upfront investment in equipment acquisition, enhancing long-term asset value but requiring significant initial outlay. OpEx (Operational Expenditures) covers ongoing costs such as maintenance, repairs, and leasing fees, allowing for flexible budgeting without large capital commitments. Balancing CapEx and OpEx is crucial for optimizing cash flow and aligning equipment expenses with operational needs.

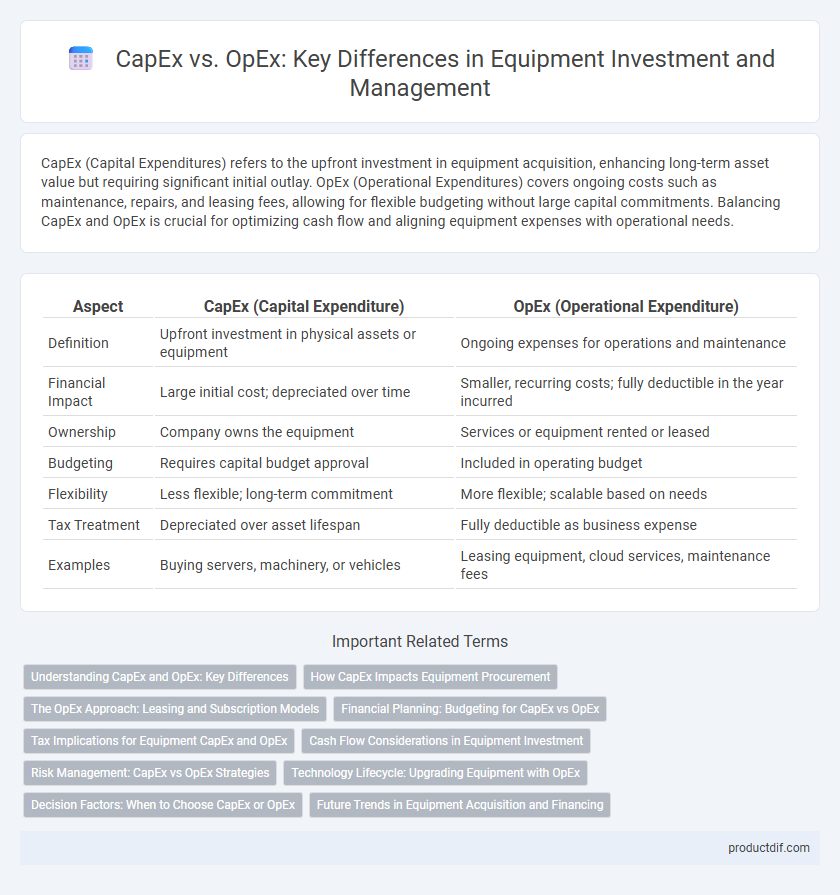

Table of Comparison

| Aspect | CapEx (Capital Expenditure) | OpEx (Operational Expenditure) |

|---|---|---|

| Definition | Upfront investment in physical assets or equipment | Ongoing expenses for operations and maintenance |

| Financial Impact | Large initial cost; depreciated over time | Smaller, recurring costs; fully deductible in the year incurred |

| Ownership | Company owns the equipment | Services or equipment rented or leased |

| Budgeting | Requires capital budget approval | Included in operating budget |

| Flexibility | Less flexible; long-term commitment | More flexible; scalable based on needs |

| Tax Treatment | Depreciated over asset lifespan | Fully deductible as business expense |

| Examples | Buying servers, machinery, or vehicles | Leasing equipment, cloud services, maintenance fees |

Understanding CapEx and OpEx: Key Differences

Capital Expenditure (CapEx) refers to the funds used by a company to acquire, upgrade, or maintain physical assets such as equipment, buildings, and technology, enabling long-term benefits and asset ownership. Operational Expenditure (OpEx) involves the ongoing costs required for the daily operation of equipment and business processes, including maintenance, utilities, and lease expenses, impacting short-term profitability. Distinguishing CapEx from OpEx is crucial for budgeting, financial reporting, and tax strategies, as CapEx is capitalized and amortized over time, while OpEx is fully expensed in the period incurred.

How CapEx Impacts Equipment Procurement

Capital Expenditure (CapEx) directly influences equipment procurement by determining budget allocation for purchasing high-value, long-term assets essential for operational efficiency. Large upfront CapEx investments often enable companies to acquire advanced, durable machinery that reduces maintenance costs and enhances production capacity over time. Strategic CapEx planning ensures optimal equipment lifecycle management, minimizing total cost of ownership and supporting sustainable business growth.

The OpEx Approach: Leasing and Subscription Models

Leasing and subscription models in equipment management shift capital expenditures to operational expenses, enabling companies to preserve cash flow and reduce upfront costs. These OpEx approaches provide flexibility through scalable access to the latest technology without the burdens of ownership, maintenance, or depreciation. By converting fixed asset investments into predictable monthly payments, businesses can optimize budgeting and adapt quickly to changing equipment needs.

Financial Planning: Budgeting for CapEx vs OpEx

Financial planning for equipment involves distinguishing CapEx and OpEx budgeting to manage costs effectively. Capital Expenditures (CapEx) require upfront investment for purchasing or upgrading physical assets, impacting cash flow and depreciation schedules. Operating Expenses (OpEx) cover ongoing costs such as maintenance, leases, and utilities, offering flexibility and improving short-term financial agility.

Tax Implications for Equipment CapEx and OpEx

Equipment CapEx (Capital Expenditures) allows businesses to depreciate assets over time, providing tax deductions linked to the asset's useful life, which can reduce taxable income gradually. OpEx (Operational Expenditures) expenses for equipment maintenance or rental are fully deductible in the year they are incurred, offering immediate tax relief. Understanding the timing and nature of these deductions is crucial for optimizing tax strategy and cash flow management in equipment investments.

Cash Flow Considerations in Equipment Investment

Evaluating CapEx versus OpEx in equipment investment profoundly impacts cash flow management, where CapEx demands substantial upfront capital expenditure, potentially constraining liquidity, while OpEx spreads costs over time through operational expenses, enhancing cash flow flexibility. Companies favor OpEx models like leasing or pay-per-use to minimize initial cash outlays and align expenses with usage, optimizing working capital. Strategic cash flow planning must balance long-term asset ownership benefits against immediate financial agility provided by operational expense structures.

Risk Management: CapEx vs OpEx Strategies

CapEx strategies involve significant upfront investment in equipment, exposing businesses to risks related to asset depreciation, obsolescence, and maintenance costs over time. OpEx approaches prioritize operational expenses, enabling flexibility and scalability while minimizing financial risks associated with large capital commitments. Effective risk management balances CapEx and OpEx by aligning equipment acquisition with long-term asset utilization and evolving technological demands.

Technology Lifecycle: Upgrading Equipment with OpEx

Upgrading equipment through OpEx enables organizations to stay current with the latest technology without large upfront investments, improving cash flow management. This approach supports faster adoption cycles by allowing periodic payments for software subscriptions, cloud services, or leased hardware. Emphasizing OpEx in technology lifecycle management ensures scalable and flexible upgrades aligned with evolving operational needs and reduces risks associated with equipment obsolescence.

Decision Factors: When to Choose CapEx or OpEx

Decision factors for choosing CapEx or OpEx depend on the nature and duration of equipment investment. CapEx is ideal for long-term ownership, offering asset control and potential tax benefits through depreciation. OpEx suits flexible needs, enabling operational expense tracking, easier budgeting, and reduced upfront costs for equipment usage.

Future Trends in Equipment Acquisition and Financing

Emerging trends in equipment acquisition favor flexible financing models, with OpEx gaining traction due to its alignment with evolving business needs and cash flow optimization. Advances in technology and the rise of IoT-enabled smart equipment drive demand for leasing and subscription-based services, reducing upfront CapEx expenditures. Sustainability considerations and rapid innovation cycles further incentivize companies to adopt operational expenditure strategies, supporting agile upgrades and minimizing asset obsolescence.

CapEx vs OpEx Infographic

productdif.com

productdif.com