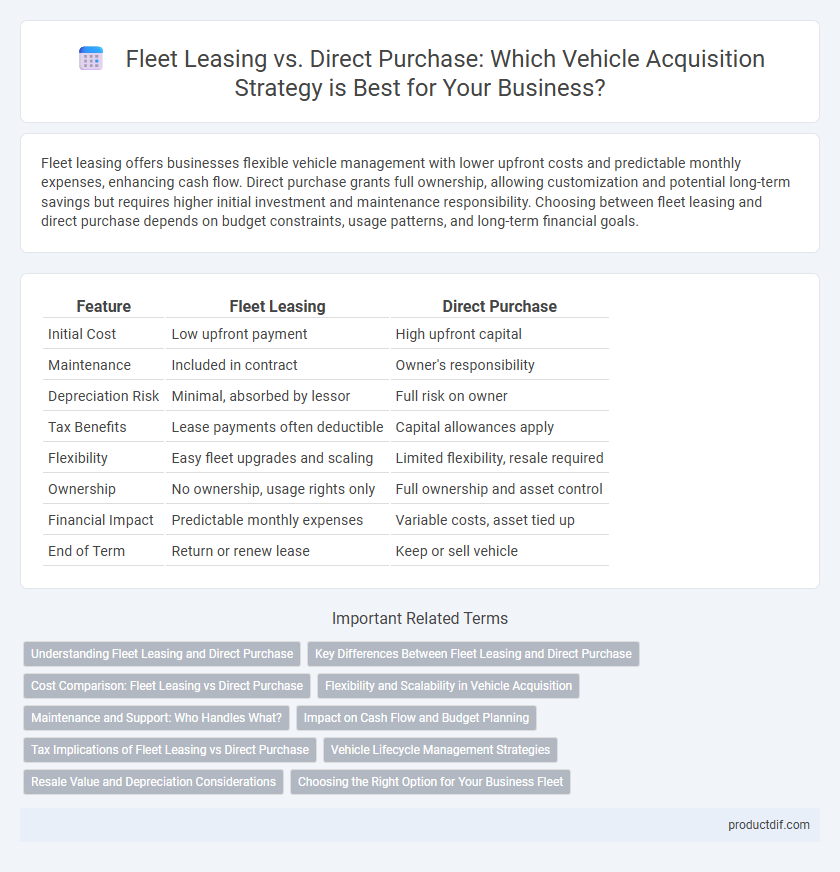

Fleet leasing offers businesses flexible vehicle management with lower upfront costs and predictable monthly expenses, enhancing cash flow. Direct purchase grants full ownership, allowing customization and potential long-term savings but requires higher initial investment and maintenance responsibility. Choosing between fleet leasing and direct purchase depends on budget constraints, usage patterns, and long-term financial goals.

Table of Comparison

| Feature | Fleet Leasing | Direct Purchase |

|---|---|---|

| Initial Cost | Low upfront payment | High upfront capital |

| Maintenance | Included in contract | Owner's responsibility |

| Depreciation Risk | Minimal, absorbed by lessor | Full risk on owner |

| Tax Benefits | Lease payments often deductible | Capital allowances apply |

| Flexibility | Easy fleet upgrades and scaling | Limited flexibility, resale required |

| Ownership | No ownership, usage rights only | Full ownership and asset control |

| Financial Impact | Predictable monthly expenses | Variable costs, asset tied up |

| End of Term | Return or renew lease | Keep or sell vehicle |

Understanding Fleet Leasing and Direct Purchase

Fleet leasing offers businesses flexible vehicle management by providing access to a range of vehicles without the upfront capital investment, often including maintenance and insurance packages. Direct purchase involves acquiring vehicles outright, granting full ownership and control but requiring significant initial expenditure and long-term responsibility for depreciation and upkeep. Choosing between fleet leasing and direct purchase depends on factors like cash flow, fleet size, usage patterns, and financial strategy.

Key Differences Between Fleet Leasing and Direct Purchase

Fleet leasing offers businesses flexibility with lower upfront costs and regular vehicle upgrades, reducing maintenance worries. Direct purchase provides full ownership, enabling asset control and potential long-term cost savings but requires higher initial investment and maintenance responsibility. Choosing depends on financial strategy, usage patterns, and fleet management capabilities.

Cost Comparison: Fleet Leasing vs Direct Purchase

Fleet leasing offers predictable monthly expenses, reducing upfront capital outlays and including maintenance and insurance in the package, which can lower overall operational costs compared to direct purchase. Direct vehicle purchase typically requires significant initial investment and subjects fleet managers to depreciation risks, fluctuating maintenance expenses, and potential resale value uncertainty. Evaluating total cost of ownership, fleet leasing often results in better cash flow management and cost efficiency, especially for businesses prioritizing flexibility and updated vehicle access.

Flexibility and Scalability in Vehicle Acquisition

Fleet leasing offers greater flexibility and scalability in vehicle acquisition by allowing businesses to adjust the number and type of vehicles according to changing operational needs without large upfront costs. Direct purchase involves a fixed investment and limits the ability to scale quickly as vehicle demands fluctuate. Leasing agreements often include maintenance and upgrades, enhancing the adaptability of fleet management.

Maintenance and Support: Who Handles What?

Fleet leasing companies typically manage regular vehicle maintenance, repairs, and support services as part of the lease agreement, ensuring minimal downtime and predictable expenses for businesses. Direct purchase owners are responsible for scheduling and covering all maintenance costs, which can require dedicated resources and potentially lead to variable spending over time. Leasing arrangements often include access to roadside assistance and vehicle replacement options, providing a comprehensive support structure absent in outright vehicle ownership.

Impact on Cash Flow and Budget Planning

Fleet leasing preserves cash flow by spreading vehicle costs into predictable monthly payments, reducing upfront expenses and minimizing budget fluctuations. Direct purchase requires significant initial capital outlay, impacting liquidity and tying up funds that could be used for other operational needs. Leasing also offers flexible terms that facilitate more accurate budget planning compared to the variable depreciation and maintenance costs associated with ownership.

Tax Implications of Fleet Leasing vs Direct Purchase

Fleet leasing offers significant tax advantages by allowing businesses to deduct lease payments as operating expenses, reducing taxable income more consistently over the lease term. In contrast, direct purchase requires capital expenditure with depreciation deductions spread across several years, potentially leading to higher upfront tax liabilities. Businesses must evaluate cash flow impacts and tax benefits to determine the optimal vehicle acquisition strategy.

Vehicle Lifecycle Management Strategies

Fleet leasing offers flexible vehicle lifecycle management by enabling regular fleet upgrades and reducing maintenance costs through bundled service agreements. Direct purchase provides long-term asset control and potential tax benefits but requires proactive management of depreciation, maintenance scheduling, and resale value. Optimizing fleet performance hinges on balancing upfront investment with ongoing operational efficiency tailored to specific business needs.

Resale Value and Depreciation Considerations

Fleet leasing offers better protection against depreciation risks by transferring the vehicle's residual value responsibility to the leasing company, resulting in more predictable costs. Direct purchase requires managing depreciation impacts directly, which can significantly reduce resale value over time, especially for vehicles with high mileage or rapid obsolescence. Businesses must evaluate the total cost of ownership, factoring in potential resale values and market demand fluctuations to optimize financial outcomes.

Choosing the Right Option for Your Business Fleet

Fleet leasing offers businesses enhanced cash flow management and flexibility with regularly updated vehicles, ideal for companies prioritizing operational efficiency. Direct purchase provides full ownership, tax advantages, and long-term asset value, suitable for businesses aiming for asset control and depreciation benefits. Analyzing factors like budget, fleet size, maintenance resources, and tax implications ensures the optimal decision for your business fleet strategy.

Fleet Leasing vs Direct Purchase Infographic

productdif.com

productdif.com