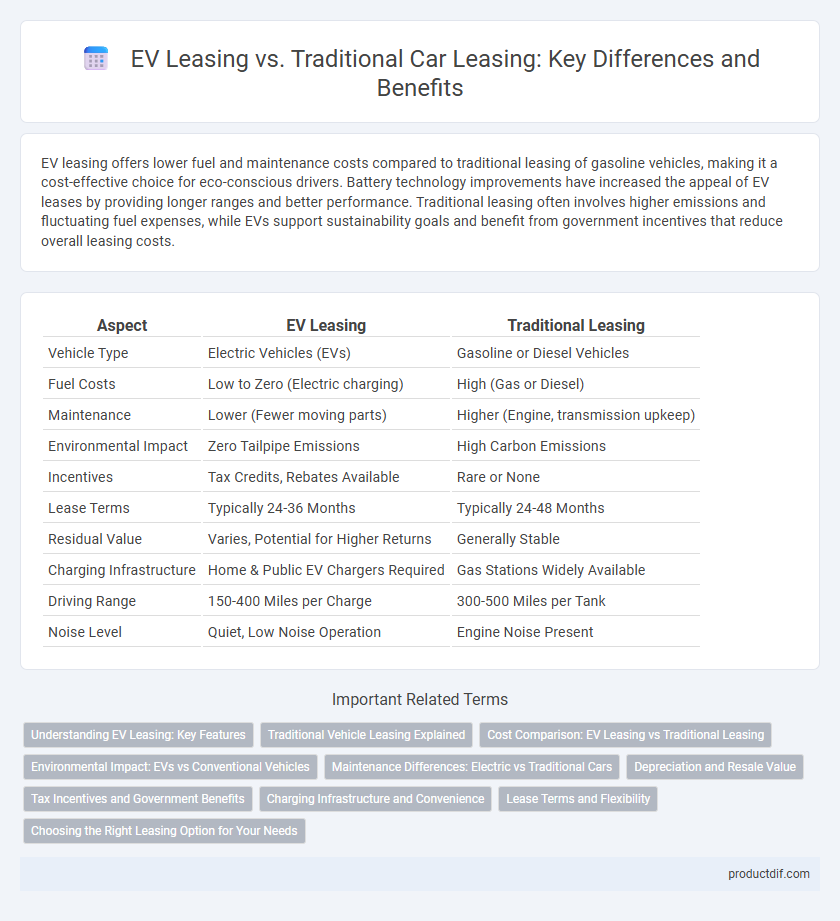

EV leasing offers lower fuel and maintenance costs compared to traditional leasing of gasoline vehicles, making it a cost-effective choice for eco-conscious drivers. Battery technology improvements have increased the appeal of EV leases by providing longer ranges and better performance. Traditional leasing often involves higher emissions and fluctuating fuel expenses, while EVs support sustainability goals and benefit from government incentives that reduce overall leasing costs.

Table of Comparison

| Aspect | EV Leasing | Traditional Leasing |

|---|---|---|

| Vehicle Type | Electric Vehicles (EVs) | Gasoline or Diesel Vehicles |

| Fuel Costs | Low to Zero (Electric charging) | High (Gas or Diesel) |

| Maintenance | Lower (Fewer moving parts) | Higher (Engine, transmission upkeep) |

| Environmental Impact | Zero Tailpipe Emissions | High Carbon Emissions |

| Incentives | Tax Credits, Rebates Available | Rare or None |

| Lease Terms | Typically 24-36 Months | Typically 24-48 Months |

| Residual Value | Varies, Potential for Higher Returns | Generally Stable |

| Charging Infrastructure | Home & Public EV Chargers Required | Gas Stations Widely Available |

| Driving Range | 150-400 Miles per Charge | 300-500 Miles per Tank |

| Noise Level | Quiet, Low Noise Operation | Engine Noise Present |

Understanding EV Leasing: Key Features

EV leasing offers distinct advantages such as lower monthly payments, tax incentives, and reduced maintenance compared to traditional leasing. It often includes charging infrastructure support and battery warranty coverage, enhancing cost-effectiveness for electric vehicle users. Understanding these key features helps consumers make informed decisions between electric and gasoline-powered vehicle leases.

Traditional Vehicle Leasing Explained

Traditional vehicle leasing involves renting a combustion engine car for a fixed term, typically 24 to 48 months, with predetermined mileage limits and monthly payments that cover depreciation and interest. This leasing model often requires a down payment and includes maintenance terms that vary by provider, making it essential to evaluate contract details carefully. Residual value plays a crucial role in determining monthly lease costs, with vehicle make, model, and usage expectations directly impacting lease pricing and end-of-term options.

Cost Comparison: EV Leasing vs Traditional Leasing

EV leasing typically offers lower monthly payments compared to traditional gasoline vehicle leasing due to incentives, reduced maintenance costs, and higher depreciation rates for electric vehicles. Traditional leasing often includes higher fuel expenses and maintenance fees that increase overall cost. Evaluating total cost of ownership highlights EV leasing as a more cost-effective option over standard internal combustion engine vehicle leases.

Environmental Impact: EVs vs Conventional Vehicles

EV leasing significantly reduces carbon emissions compared to traditional leasing of gasoline or diesel vehicles, contributing to lower urban air pollution and decreased greenhouse gas output. Electric vehicles produce zero tailpipe emissions and benefit from renewable energy integration when charged from green power sources, enhancing overall environmental sustainability. Conventional vehicles rely on fossil fuels, resulting in continuous CO2 emissions and higher environmental degradation throughout their lifecycle.

Maintenance Differences: Electric vs Traditional Cars

EV leasing offers significantly lower maintenance costs compared to traditional car leases due to fewer moving parts and the absence of oil changes, timing belts, and exhaust system repairs. Traditional vehicles require regular maintenance such as engine tune-ups, transmission fluid changes, and brake pad replacements, which increase overall leasing expenses. Battery health monitoring and software updates in electric vehicles further reduce unexpected maintenance costs throughout the lease term.

Depreciation and Resale Value

Electric vehicle (EV) leasing generally experiences slower depreciation compared to traditional internal combustion engine (ICE) vehicles due to rising demand and advancing battery technology, which helps maintain higher resale values. Traditional vehicles often suffer steeper depreciation driven by fuel price volatility and stricter emission regulations, negatively impacting their long-term resale potential. Lessees choosing EVs benefit from more stable residual values, reducing total cost of ownership and enhancing investment returns over the lease period.

Tax Incentives and Government Benefits

Electric vehicle (EV) leasing often includes significant tax incentives such as federal tax credits up to $7,500, state rebates, and reduced registration fees, which lower the overall cost compared to traditional leasing. Governments promote EV adoption through benefits like access to HOV lanes and reduced or waived sales tax, making EV leases financially more attractive. Traditional vehicle leases generally lack these specific subsidies, resulting in higher long-term expenses and fewer financial perks.

Charging Infrastructure and Convenience

EV leasing offers seamless access to expanding charging networks such as Tesla Superchargers and Electrify America, enhancing convenience for city and highway driving. Traditional leasing lacks integrated charging support, often requiring separate arrangements for fuel access, which limits ease of use. The widespread rollout of home and public EV chargers significantly reduces range anxiety, making EV leasing a practical choice for modern commuters.

Lease Terms and Flexibility

EV leasing often includes shorter lease terms, typically ranging from 24 to 36 months, allowing lessees to upgrade to newer electric models as technology advances rapidly. Traditional leasing usually offers longer terms, often 36 to 48 months, providing stable monthly payments but less frequent upgrades. Flexibility in EV leases may also involve mileage allowances tailored to electric vehicle usage patterns and potential incentives for lower emissions.

Choosing the Right Leasing Option for Your Needs

EV leasing offers lower maintenance costs and potential tax incentives, making it ideal for eco-conscious drivers who want to save on operational expenses. Traditional leasing often provides a wider selection of models and typically includes predictable monthly payments, suitable for those prioritizing variety and budget stability. Evaluating your driving habits, budget, and long-term vehicle goals helps determine whether EV leasing or traditional leasing aligns best with your needs.

EV Leasing vs Traditional Leasing Infographic

productdif.com

productdif.com