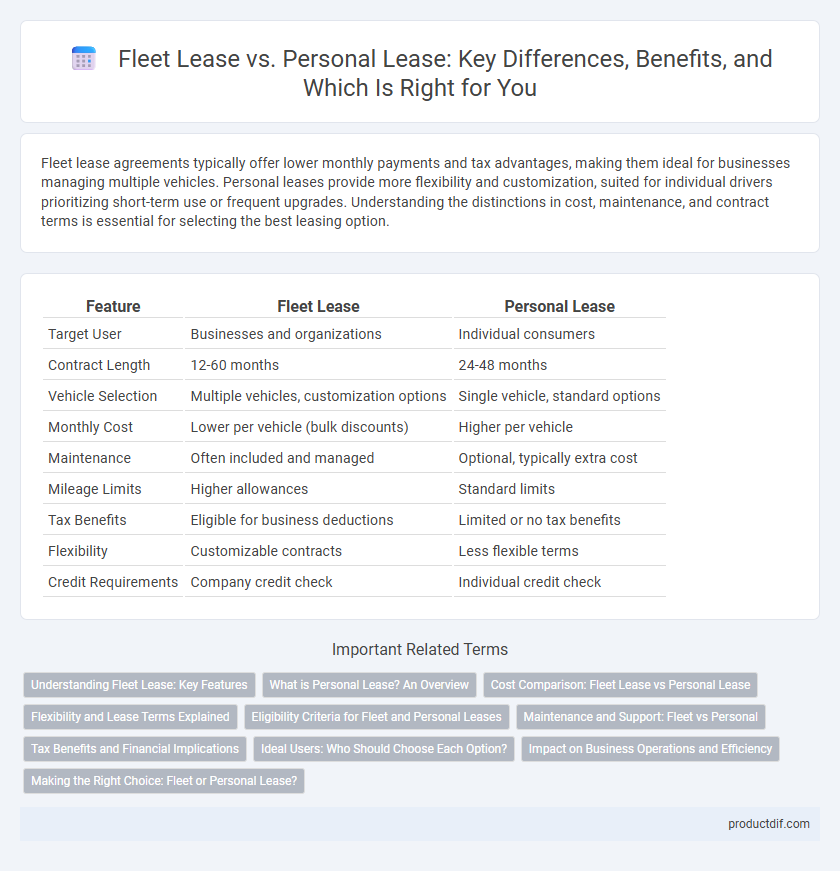

Fleet lease agreements typically offer lower monthly payments and tax advantages, making them ideal for businesses managing multiple vehicles. Personal leases provide more flexibility and customization, suited for individual drivers prioritizing short-term use or frequent upgrades. Understanding the distinctions in cost, maintenance, and contract terms is essential for selecting the best leasing option.

Table of Comparison

| Feature | Fleet Lease | Personal Lease |

|---|---|---|

| Target User | Businesses and organizations | Individual consumers |

| Contract Length | 12-60 months | 24-48 months |

| Vehicle Selection | Multiple vehicles, customization options | Single vehicle, standard options |

| Monthly Cost | Lower per vehicle (bulk discounts) | Higher per vehicle |

| Maintenance | Often included and managed | Optional, typically extra cost |

| Mileage Limits | Higher allowances | Standard limits |

| Tax Benefits | Eligible for business deductions | Limited or no tax benefits |

| Flexibility | Customizable contracts | Less flexible terms |

| Credit Requirements | Company credit check | Individual credit check |

Understanding Fleet Lease: Key Features

Fleet lease agreements typically cover a group of vehicles leased by businesses, offering lower monthly payments due to bulk leasing discounts and standardized maintenance packages. Key features include flexible contract terms tailored to company needs, comprehensive vehicle management services, and tax benefits such as deductible lease payments. Companies benefit from streamlined administrative processes and reduced depreciation risks compared to individual personal leases.

What is Personal Lease? An Overview

Personal lease is a vehicle rental agreement designed for individual drivers, offering fixed monthly payments over a set term without ownership responsibilities. It typically includes maintenance, insurance packages, and mileage limits tailored to personal use. This option provides flexibility and cost predictability, making it ideal for those who prefer driving new cars without long-term commitment.

Cost Comparison: Fleet Lease vs Personal Lease

Fleet lease agreements typically offer lower monthly payments and reduced upfront costs compared to personal leases due to bulk purchasing power and negotiated corporate discounts. Personal leases often have higher interest rates and less favorable terms, increasing the overall cost of leasing a vehicle for individual consumers. Evaluating total lease expenses, including maintenance and mileage allowances, highlights fleet leases as the more cost-effective option for businesses managing multiple vehicles.

Flexibility and Lease Terms Explained

Fleet leases offer greater flexibility with customizable lease terms tailored for businesses managing multiple vehicles, including options for varied mileage allowances and maintenance packages. Personal leases generally have fixed terms, typically lasting 24 to 36 months, with standard mileage limits and fewer opportunities for adjustment. Understanding these distinctions helps optimize costs and vehicle usage based on individual or corporate needs.

Eligibility Criteria for Fleet and Personal Leases

Fleet lease eligibility often requires businesses to demonstrate a stable financial history, maintain a minimum number of vehicles, and provide proof of commercial use. Personal lease qualifications typically hinge on individual credit scores, employment verification, and income stability. Both lease types prioritize applicants with a clean driving record to mitigate risk and ensure vehicle maintenance compliance.

Maintenance and Support: Fleet vs Personal

Fleet leases typically include comprehensive maintenance and support services bundled into the contract, ensuring regular servicing, repairs, and roadside assistance are managed by the leasing company, reducing downtime. Personal leases may offer maintenance packages, but they often require additional fees and limited support, leaving individuals responsible for routine upkeep and unexpected repairs. The structured maintenance in fleet leases results in predictable costs and professional support, while personal leaseholders may face variable expenses and greater logistical challenges.

Tax Benefits and Financial Implications

Fleet leases offer significant tax benefits for businesses, including the ability to deduct lease payments as a business expense and potential VAT recovery on expenses, reducing overall taxable income. Personal leases generally lack these tax advantages because payments are considered personal expenses, limiting write-offs and tax relief. Financially, fleet leasing often provides better cash flow management and lower overall costs for companies due to bulk negotiation and maintenance packages, while personal leasing may carry higher monthly payments without associated business tax incentives.

Ideal Users: Who Should Choose Each Option?

Fleet leases are ideal for businesses managing multiple vehicles, offering cost-effective solutions with consolidated billing, maintenance packages, and tailored fleet management services. Personal leases suit individual drivers seeking flexibility and lower monthly payments without the complexities of commercial use or corporate tax benefits. Entrepreneurs and small business owners with minimal vehicle needs may benefit from personal leases, while large companies or organizations with extensive transportation demands should opt for fleet leasing to maximize efficiency.

Impact on Business Operations and Efficiency

Fleet lease programs provide businesses with standardized vehicles and bulk maintenance packages, reducing downtime and streamlining operational logistics. Personal leases typically lack flexible terms suited for commercial usage, resulting in higher administrative overhead and inconsistent vehicle availability. Optimizing fleet leasing enhances cost control and improves overall business efficiency through dedicated account management and tailored vehicle selections.

Making the Right Choice: Fleet or Personal Lease?

Choosing between a fleet lease and a personal lease depends on the vehicle usage, financial goals, and business or personal needs. Fleet leases offer cost-effective solutions with maintenance packages tailored for multiple vehicles, ideal for businesses seeking operational efficiency and tax benefits. Personal leases prioritize flexibility and lower monthly payments for individual users without long-term ownership commitments.

Fleet Lease vs Personal Lease Infographic

productdif.com

productdif.com