Car leasing offers lower monthly payments and the flexibility to drive a new vehicle every few years, making it ideal for those who prefer short-term commitments and minimal maintenance costs. Car financing involves taking a loan to purchase a vehicle, resulting in higher monthly payments but full ownership and the ability to customize or keep the car long-term. Choosing between leasing and financing depends on budget preferences, driving habits, and long-term vehicle goals.

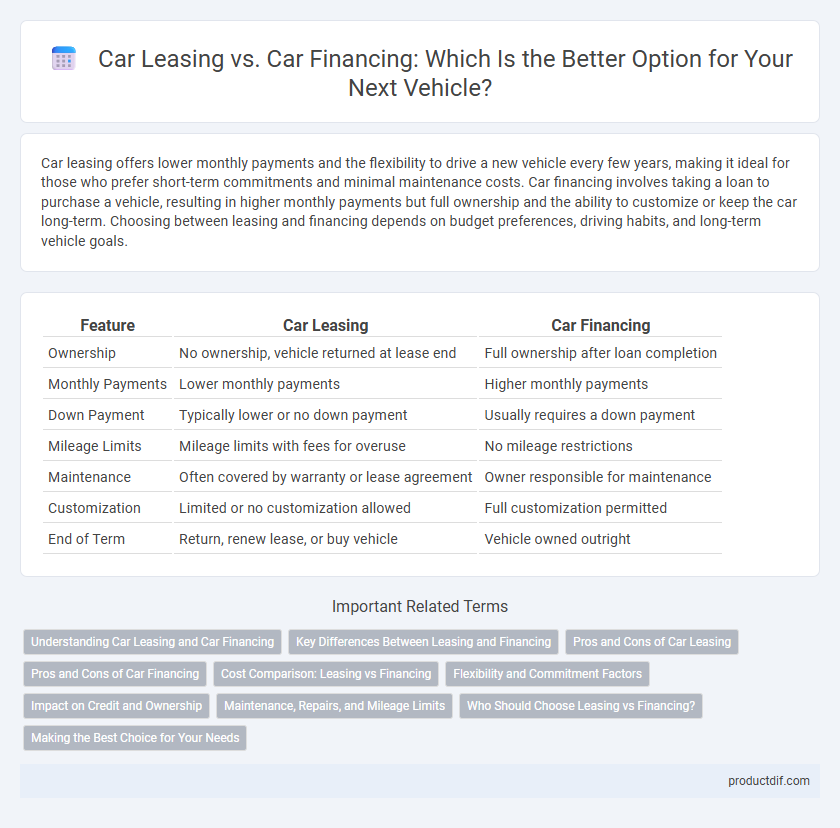

Table of Comparison

| Feature | Car Leasing | Car Financing |

|---|---|---|

| Ownership | No ownership, vehicle returned at lease end | Full ownership after loan completion |

| Monthly Payments | Lower monthly payments | Higher monthly payments |

| Down Payment | Typically lower or no down payment | Usually requires a down payment |

| Mileage Limits | Mileage limits with fees for overuse | No mileage restrictions |

| Maintenance | Often covered by warranty or lease agreement | Owner responsible for maintenance |

| Customization | Limited or no customization allowed | Full customization permitted |

| End of Term | Return, renew lease, or buy vehicle | Vehicle owned outright |

Understanding Car Leasing and Car Financing

Car leasing allows drivers to use a vehicle for a fixed period with lower monthly payments, while car financing involves purchasing the car through a loan with higher monthly payments and eventual ownership. Leasing typically limits mileage and requires vehicle care to avoid penalties, whereas financing provides unlimited driving and long-term equity in the vehicle. Understanding these differences helps consumers choose between short-term flexibility and long-term investment based on their financial goals and driving habits.

Key Differences Between Leasing and Financing

Car leasing involves paying for the use of a vehicle over a fixed term with lower monthly payments, while car financing requires purchasing the vehicle through a loan, resulting in higher monthly installments but eventual ownership. Leasing contracts typically include mileage limits and maintenance requirements, whereas financing grants full control without such restrictions. Ownership transfer occurs at the end of a financing loan, while leasing returns the vehicle to the dealer.

Pros and Cons of Car Leasing

Car leasing offers lower monthly payments and access to newer vehicle models with minimal upfront costs, making it ideal for drivers who prefer regularly updated cars and predictable expenses. However, leasing restricts mileage limits and customization options, often resulting in costly penalties for excess wear and mileage. Unlike financing, leasing does not build equity, leaving drivers without ownership at the end of the lease term.

Pros and Cons of Car Financing

Car financing offers ownership flexibility and the ability to build equity over time, making it ideal for drivers who prefer long-term investment in their vehicle. Monthly payments can be higher compared to leasing, but there are no mileage restrictions or penalties for customization. Depreciation and maintenance costs become the owner's responsibility, which can increase the total cost of ownership.

Cost Comparison: Leasing vs Financing

Car leasing typically offers lower monthly payments compared to car financing due to reduced upfront costs and the absence of interest on the full vehicle price. Financing involves higher monthly payments as borrowers repay the entire loan amount plus interest, but it leads to eventual ownership and asset equity. Over the long term, leasing may result in higher cumulative costs without vehicle ownership benefits, while financing can be more cost-effective for drivers who keep cars beyond loan terms.

Flexibility and Commitment Factors

Car leasing offers greater flexibility with shorter contract terms typically ranging from 2 to 4 years, allowing drivers to switch vehicles regularly without long-term commitment. Car financing involves longer loan periods, usually between 3 to 7 years, leading to higher commitment but eventual ownership of the vehicle. Leasing contracts often include mileage limits and fees for excess use, while financing provides unlimited vehicle use but requires consistent monthly payments until the loan is paid off.

Impact on Credit and Ownership

Car leasing typically has less impact on credit scores as monthly payments are generally lower and leases are considered less risky by lenders, while financing a car often requires higher monthly payments and longer loan terms, which can affect credit utilization and debt-to-income ratios more significantly. Leasing does not build vehicle ownership equity, as the car remains the property of the leasing company, whereas financing culminates in full ownership once the loan is paid off, allowing the borrower to build asset value. Understanding these differences is crucial for consumers evaluating how their credit profiles and long-term vehicle ownership goals align with leasing or financing options.

Maintenance, Repairs, and Mileage Limits

Car leasing typically covers routine maintenance and repairs within the lease agreement, reducing out-of-pocket expenses, while financing a vehicle places full responsibility for maintenance and repairs on the owner. Mileage limits in leasing contracts often range between 10,000 to 15,000 miles per year, with penalties for exceeding these limits, whereas financing offers unlimited mileage without extra fees. Understanding these differences is crucial for budgeting and managing long-term vehicle ownership costs.

Who Should Choose Leasing vs Financing?

Car leasing suits drivers who prefer lower monthly payments, want to upgrade vehicles frequently, and drive within mileage limits, making it ideal for those seeking flexibility without long-term commitment. Financing benefits buyers who plan to keep the car long-term, desire full ownership after payments, and want unrestricted mileage, appealing to individuals focused on asset building and customization. Choosing between leasing and financing depends on personal driving habits, financial goals, and preferences for ownership versus temporary use.

Making the Best Choice for Your Needs

Choosing between car leasing and car financing depends on your financial goals, driving habits, and ownership preferences. Leasing offers lower monthly payments and access to newer models every few years, ideal for drivers who prefer flexibility and warranty coverage. Financing builds equity and allows unlimited mileage, making it the best option for long-term ownership and those who drive extensively.

Car Leasing vs Car Financing Infographic

productdif.com

productdif.com