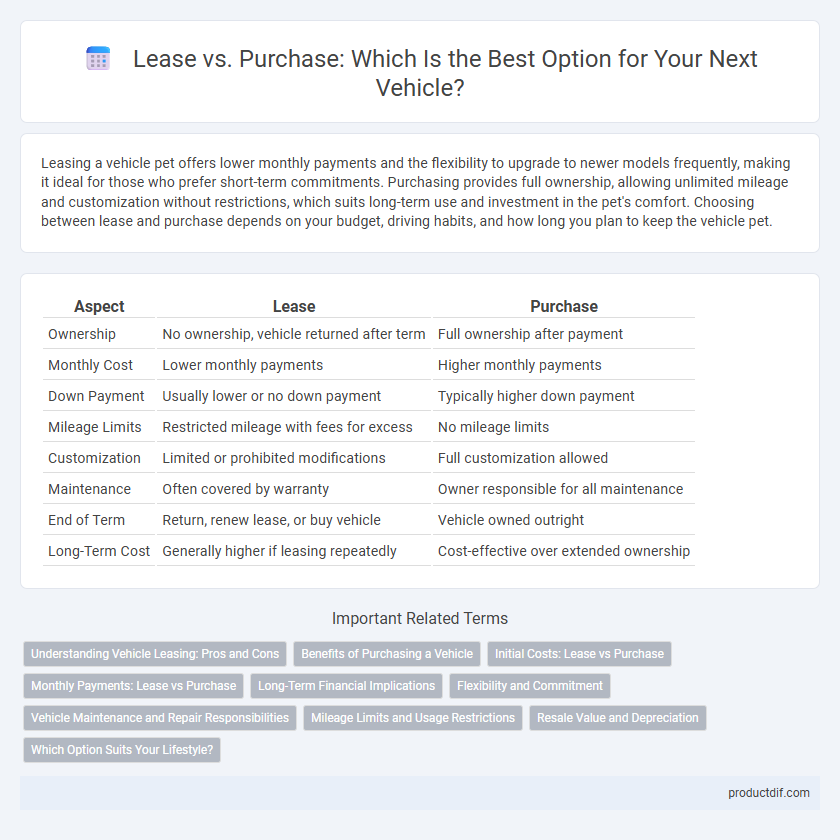

Leasing a vehicle pet offers lower monthly payments and the flexibility to upgrade to newer models frequently, making it ideal for those who prefer short-term commitments. Purchasing provides full ownership, allowing unlimited mileage and customization without restrictions, which suits long-term use and investment in the pet's comfort. Choosing between lease and purchase depends on your budget, driving habits, and how long you plan to keep the vehicle pet.

Table of Comparison

| Aspect | Lease | Purchase |

|---|---|---|

| Ownership | No ownership, vehicle returned after term | Full ownership after payment |

| Monthly Cost | Lower monthly payments | Higher monthly payments |

| Down Payment | Usually lower or no down payment | Typically higher down payment |

| Mileage Limits | Restricted mileage with fees for excess | No mileage limits |

| Customization | Limited or prohibited modifications | Full customization allowed |

| Maintenance | Often covered by warranty | Owner responsible for all maintenance |

| End of Term | Return, renew lease, or buy vehicle | Vehicle owned outright |

| Long-Term Cost | Generally higher if leasing repeatedly | Cost-effective over extended ownership |

Understanding Vehicle Leasing: Pros and Cons

Vehicle leasing offers lower monthly payments and access to newer models without the long-term commitment of ownership, making it ideal for those seeking flexibility and reduced maintenance costs. However, leases often come with mileage limits and potential fees for wear and tear, which can increase costs if not carefully managed. Understanding the balance between these pros and cons helps drivers decide whether leasing suits their financial goals and driving habits better than purchasing.

Benefits of Purchasing a Vehicle

Purchasing a vehicle offers long-term financial advantages by eliminating monthly lease payments and building equity over time. Ownership provides unrestricted mileage, customization options, and the ability to sell or trade the vehicle at any point. Maintenance costs may decrease as owners can opt for repairs rather than adhere to lease agreements, maximizing overall value.

Initial Costs: Lease vs Purchase

Leasing a vehicle typically requires a lower initial cost, often limited to the first month's payment, a security deposit, and possible fees, making it more accessible upfront. Purchasing a vehicle demands a higher initial outlay, including a down payment that may range from 10% to 20% of the vehicle's price, taxes, registration, and other fees. Understanding these initial cost differences helps buyers match their financial situation and long-term vehicle needs with the most suitable option.

Monthly Payments: Lease vs Purchase

Monthly lease payments are generally lower than loan payments because leases cover only the vehicle's depreciation during the term, plus interest and fees, rather than the entire purchase price. Purchase loan payments are typically higher since they amortize the full cost of the vehicle, including interest, over the loan period. Leasing offers predictable monthly expenses with lower upfront costs, whereas purchasing builds equity but demands higher monthly financial commitment.

Long-Term Financial Implications

Leasing a vehicle often results in lower monthly payments but can lead to higher overall costs due to continuous payments without ownership equity. Purchasing a vehicle typically requires higher initial expenses and monthly payments but offers long-term financial benefits through asset accumulation and potential resale value. Evaluating factors like depreciation, interest rates, and maintenance costs is crucial to understanding the best financial strategy for individual needs and financial goals.

Flexibility and Commitment

Opting for a vehicle lease offers greater flexibility with shorter contract terms and easy upgrades to newer models, ideal for those valuing adaptability. Purchasing a vehicle requires a higher initial investment but provides full ownership and long-term commitment, eliminating mileage restrictions and allowing customization. Lease agreements often include maintenance packages, reducing unforeseen costs, whereas owners bear all expenses after purchase.

Vehicle Maintenance and Repair Responsibilities

Leasing a vehicle often transfers maintenance and repair responsibilities to the dealership or leasing company, typically including routine service and warranty-covered repairs, minimizing out-of-pocket expenses. Purchasing a vehicle requires the owner to manage and finance all maintenance and repair costs after the warranty period, which can vary significantly based on vehicle age and condition. Understanding these responsibilities is crucial for budgeting long-term vehicle ownership versus short-term leasing agreements.

Mileage Limits and Usage Restrictions

Leasing a vehicle often includes strict mileage limits, typically ranging from 10,000 to 15,000 miles annually, with penalties for exceeding those limits that can increase overall costs. Purchasing a vehicle removes mileage restrictions, allowing unlimited use and greater flexibility for high-mileage drivers or extensive travel needs. Usage restrictions in leases may also limit modifications and require maintenance compliance, whereas ownership grants full control over vehicle customization and servicing choices.

Resale Value and Depreciation

Leasing a vehicle often results in lower upfront costs but means you avoid concerns about depreciation and resale value, as you return the car at lease-end. Purchasing a vehicle involves higher initial expenses but allows owners to benefit from residual resale value, although vehicles typically depreciate 20-30% within the first year. Understanding depreciation rates and market demand for specific models can significantly impact the long-term financial advantage between leasing and buying.

Which Option Suits Your Lifestyle?

Choosing between leasing and purchasing a vehicle depends on your driving habits, financial goals, and long-term plans. Leasing suits those who prefer lower monthly payments, drive fewer miles annually, and enjoy upgrading to a new car every few years. Purchasing benefits individuals who drive extensively, want ownership equity, and plan to keep the vehicle for a longer period.

Lease vs Purchase Infographic

productdif.com

productdif.com