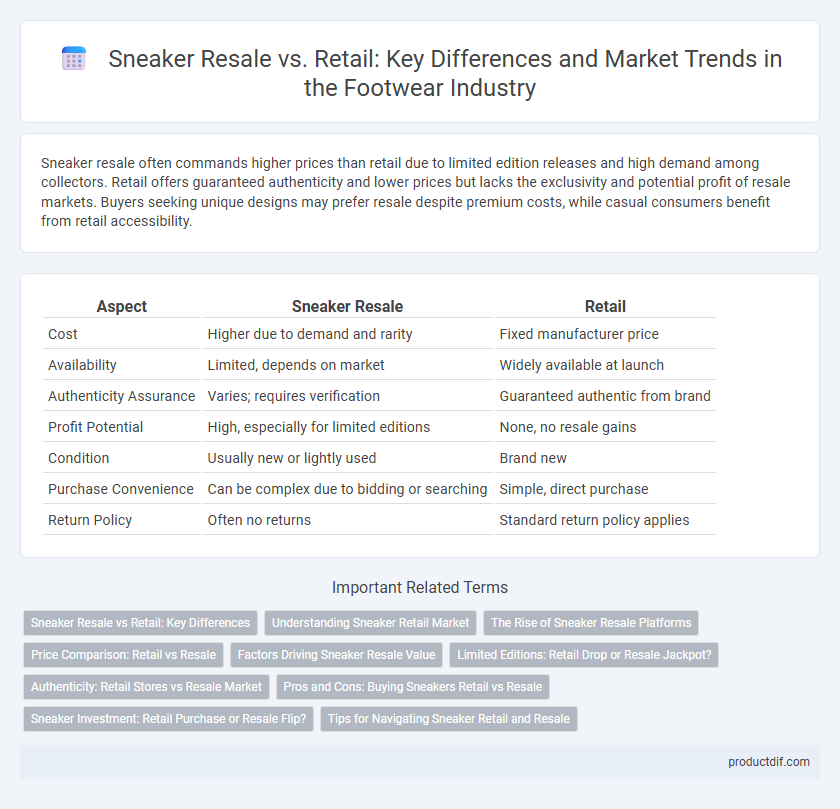

Sneaker resale often commands higher prices than retail due to limited edition releases and high demand among collectors. Retail offers guaranteed authenticity and lower prices but lacks the exclusivity and potential profit of resale markets. Buyers seeking unique designs may prefer resale despite premium costs, while casual consumers benefit from retail accessibility.

Table of Comparison

| Aspect | Sneaker Resale | Retail |

|---|---|---|

| Cost | Higher due to demand and rarity | Fixed manufacturer price |

| Availability | Limited, depends on market | Widely available at launch |

| Authenticity Assurance | Varies; requires verification | Guaranteed authentic from brand |

| Profit Potential | High, especially for limited editions | None, no resale gains |

| Condition | Usually new or lightly used | Brand new |

| Purchase Convenience | Can be complex due to bidding or searching | Simple, direct purchase |

| Return Policy | Often no returns | Standard return policy applies |

Sneaker Resale vs Retail: Key Differences

Sneaker resale prices often exceed retail values due to limited edition releases and high demand, creating a lucrative secondary market. Retail purchases guarantee authenticity and full warranty, while resale sneakers may require thorough verification to avoid counterfeits. Market trends in sneaker resale fluctuate based on brand collaborations, rarity, and cultural influence, significantly impacting price and accessibility compared to retail options.

Understanding Sneaker Retail Market

The sneaker retail market is driven by major brands such as Nike, Adidas, and Puma, which release limited-edition runs to create scarcity and hype. Retail prices are generally standardized, but demand and exclusivity heavily influence the secondary resale market, sometimes causing resale values to surpass original retail costs by several multiples. Understanding consumer trends, release schedules, and regional preferences is crucial for navigating the fluctuating dynamics between sneaker retail availability and resale profitability.

The Rise of Sneaker Resale Platforms

Sneaker resale platforms have revolutionized the footwear market by creating a dynamic ecosystem where limited-edition drops and exclusive collaborations generate significant aftermarket value. The surge in these platforms, such as StockX and GOAT, leverages real-time pricing algorithms and authentication processes to ensure transparency and trust among buyers and sellers. This growth shifts market dynamics, often pushing resale prices well above retail, driven by demand for rare sneakers and the cultural status they confer.

Price Comparison: Retail vs Resale

Sneaker resale prices often exceed retail prices due to limited edition releases and high demand among collectors. Retail sneaker prices typically range from $100 to $200, while resale values can surge to several times that amount, sometimes reaching over $1,000 for rare models. Market platforms like StockX and GOAT highlight significant price disparities, emphasizing scarcity and hype as key factors driving resale premiums.

Factors Driving Sneaker Resale Value

Limited edition releases, brand collaborations, and athlete endorsements significantly drive sneaker resale value by creating scarcity and heightened demand. Market trends, sneaker condition, and original packaging further influence resale prices, with collectors prioritizing pristine, ungirdled pairs. Geographic location and hype on social media platforms also amplify resale value by expanding buyer reach and competition.

Limited Editions: Retail Drop or Resale Jackpot?

Limited edition sneakers often spark intense demand, making retail drops a coveted opportunity for collectors seeking authentic, brand-new pairs at retail prices. Resale markets, however, capitalize on scarcity, with rare models frequently doubling or tripling retail value due to exclusivity and hype. Understanding market trends and release data helps buyers decide between the guaranteed retail price or the potential profit--and risk--in resale transactions.

Authenticity: Retail Stores vs Resale Market

Retail stores guarantee sneaker authenticity by sourcing directly from brands or authorized distributors, ensuring customers receive genuine products with manufacturer warranties. The resale market poses risks of counterfeit or altered sneakers, as authentication relies on third-party services and buyer vigilance to verify legitimacy. Verified resale platforms use advanced authentication technology and expert inspectors to minimize fraud, but inherent authenticity assurance remains stronger in retail environments.

Pros and Cons: Buying Sneakers Retail vs Resale

Buying sneakers retail guarantees authenticity, full retail price, and access to the latest releases directly from brands or authorized sellers. Sneaker resale offers immediate availability for sold-out models and potential investment gains but involves higher prices and risks of counterfeit products. Consumers must weigh the reliability and cost benefits of retail against the exclusivity and premium pricing of resale markets.

Sneaker Investment: Retail Purchase or Resale Flip?

Sneaker investment often hinges on whether to buy at retail or flip on the resale market, with retail purchases providing guaranteed access to limited editions and resale offering higher profit potential through market demand fluctuations. Retail prices typically range from $100 to $250 for high-demand releases, while resale can double or triple these amounts depending on rarity and hype. Understanding trends in sneaker culture, brand collaborations, and exclusivity is key to maximizing returns in this competitive market.

Tips for Navigating Sneaker Retail and Resale

Understanding sneaker resale value trends helps buyers make informed purchase decisions, maximizing investment potential in popular models. Monitoring release dates, limited editions, and collaborations increases chances of securing retail pairs below resale prices. Using verified marketplaces and authenticating sneakers ensures safe transactions and protects against counterfeit products in the resale market.

Sneaker Resale vs Retail Infographic

productdif.com

productdif.com