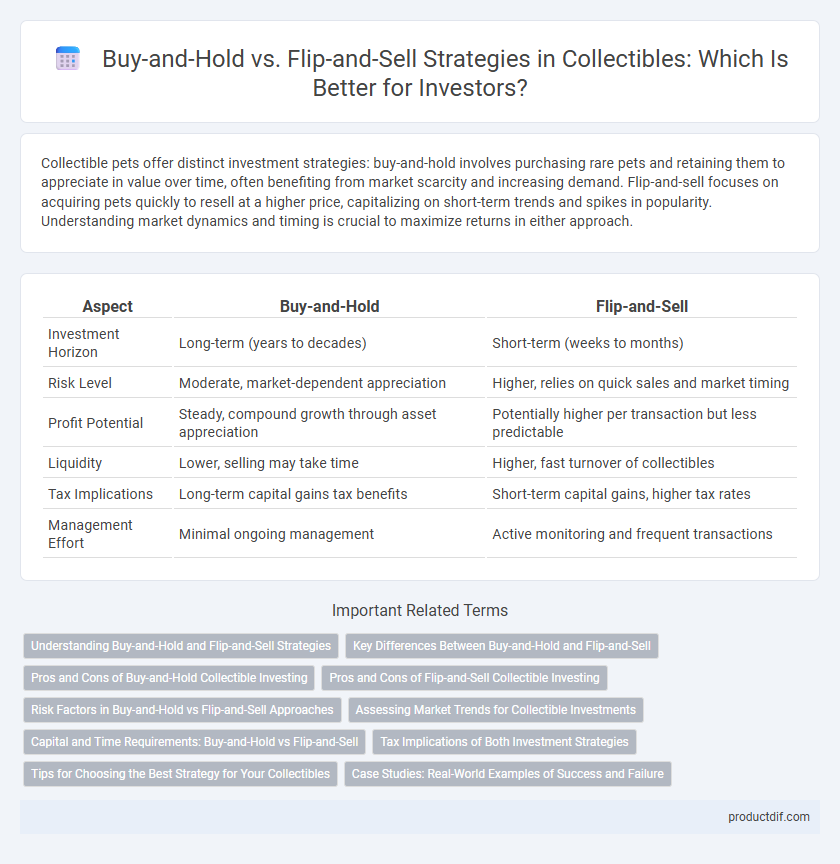

Collectible pets offer distinct investment strategies: buy-and-hold involves purchasing rare pets and retaining them to appreciate in value over time, often benefiting from market scarcity and increasing demand. Flip-and-sell focuses on acquiring pets quickly to resell at a higher price, capitalizing on short-term trends and spikes in popularity. Understanding market dynamics and timing is crucial to maximize returns in either approach.

Table of Comparison

| Aspect | Buy-and-Hold | Flip-and-Sell |

|---|---|---|

| Investment Horizon | Long-term (years to decades) | Short-term (weeks to months) |

| Risk Level | Moderate, market-dependent appreciation | Higher, relies on quick sales and market timing |

| Profit Potential | Steady, compound growth through asset appreciation | Potentially higher per transaction but less predictable |

| Liquidity | Lower, selling may take time | Higher, fast turnover of collectibles |

| Tax Implications | Long-term capital gains tax benefits | Short-term capital gains, higher tax rates |

| Management Effort | Minimal ongoing management | Active monitoring and frequent transactions |

Understanding Buy-and-Hold and Flip-and-Sell Strategies

Buy-and-hold strategy in collectibles involves acquiring items and retaining them long-term to maximize value appreciation over time, leveraging market trends and rarity. Flip-and-sell strategy focuses on purchasing collectibles at lower prices and quickly reselling them to capitalize on short-term demand spikes or market inefficiencies. Understanding these strategies requires analyzing factors such as market volatility, collector interest, and item liquidity to optimize investment returns.

Key Differences Between Buy-and-Hold and Flip-and-Sell

Buy-and-hold involves acquiring collectibles for long-term appreciation, capitalizing on market stability and historical value growth. Flip-and-sell focuses on short-term profit by quickly reselling items that exhibit sudden market demand or trending popularity. Risk tolerance, liquidity needs, and market timing are key factors differentiating these investment strategies in the collectible market.

Pros and Cons of Buy-and-Hold Collectible Investing

Buy-and-hold collectible investing allows investors to benefit from long-term appreciation and potential rarity-driven value increases, making it ideal for those seeking stable, enduring assets. It reduces transaction costs and capital gains taxes compared to frequent flipping but requires patience and carries risks of market volatility and changing collector trends. Preservation of the collectible's condition is critical to maintaining value, yet liquidity may be limited compared to quick-flip strategies.

Pros and Cons of Flip-and-Sell Collectible Investing

Flip-and-sell collectible investing offers the advantage of quick returns by capitalizing on market trends and hype, allowing investors to swiftly realize profits. However, this strategy carries higher risks due to market volatility, potential for lower resale value, and increased transaction costs. Investors must balance speed and timing with the possibility of losses from rapid price fluctuations and demand shifts.

Risk Factors in Buy-and-Hold vs Flip-and-Sell Approaches

Buy-and-hold strategies in collectibles involve lower short-term market volatility risk but expose investors to long-term value depreciation and storage costs. Flip-and-sell approaches face higher immediate market fluctuation risks and potential liquidity constraints due to rapid transaction timing. Understanding market demand trends and provenance authenticity is crucial to mitigate risks in both buy-and-hold and flip-and-sell collectible investments.

Assessing Market Trends for Collectible Investments

Analyzing market trends in collectible investments involves studying price fluctuations, rarity demand, and historical sales data to determine optimal entry points. Long-term buy-and-hold strategies benefit from trends indicating asset appreciation over time, while flip-and-sell approaches capitalize on short-term spikes driven by hype or limited releases. Leveraging auction results, online marketplace analytics, and expert forecasts enables investors to assess risk and timing effectively in the collectibles market.

Capital and Time Requirements: Buy-and-Hold vs Flip-and-Sell

Buy-and-hold strategies in collectibles typically require significant upfront capital and long-term storage, allowing assets to appreciate over years without immediate liquidity. Flip-and-sell approaches demand less initial investment and shorter holding periods but involve active market timing and transaction costs. Understanding capital allocation and time commitment is essential for maximizing returns in collectible investments.

Tax Implications of Both Investment Strategies

Buy-and-hold investment strategies in collectibles often benefit from long-term capital gains tax rates, which are generally lower than short-term rates applied to flip-and-sell transactions. Flip-and-sell approaches typically incur higher tax liabilities due to short-term capital gains taxes, as the holding period is less than one year, classifying profits as ordinary income. Understanding the tax code for collectibles, including the 28% maximum tax rate on capital gains for certain items like art and antiques, is essential for optimizing net returns in both strategies.

Tips for Choosing the Best Strategy for Your Collectibles

Evaluate market trends and rarity when deciding between buy-and-hold or flip-and-sell strategies for collectibles to maximize long-term value or quick profits. Consider the item's historical price volatility and current demand to predict potential appreciation or rapid resale opportunities. Prioritize collectibles with proven liquidity and strong community interest to ensure optimal timing and strategy alignment.

Case Studies: Real-World Examples of Success and Failure

Buy-and-hold strategies in collectibles, exemplified by rare baseball cards appreciating over decades, demonstrate substantial long-term gains due to market scarcity and historical significance. In contrast, flip-and-sell cases like limited-edition sneakers highlight quick profits but also reveal risks of market saturation and fluctuating trends leading to losses. Successful collectible investments often depend on timing, authenticity, and understanding market cycles, as shown by contrasting outcomes in comic books versus digital art NFTs.

Buy-and-Hold vs Flip-and-Sell Infographic

productdif.com

productdif.com