Graded collectibles offer verified authenticity and condition ratings from reputable services, increasing their market value and buyer confidence. Ungraded collectibles may have more affordable prices but carry higher risks of wear, damage, or counterfeit issues. Collectors seeking long-term investment tend to prefer graded items for their transparency and resale potential.

Table of Comparison

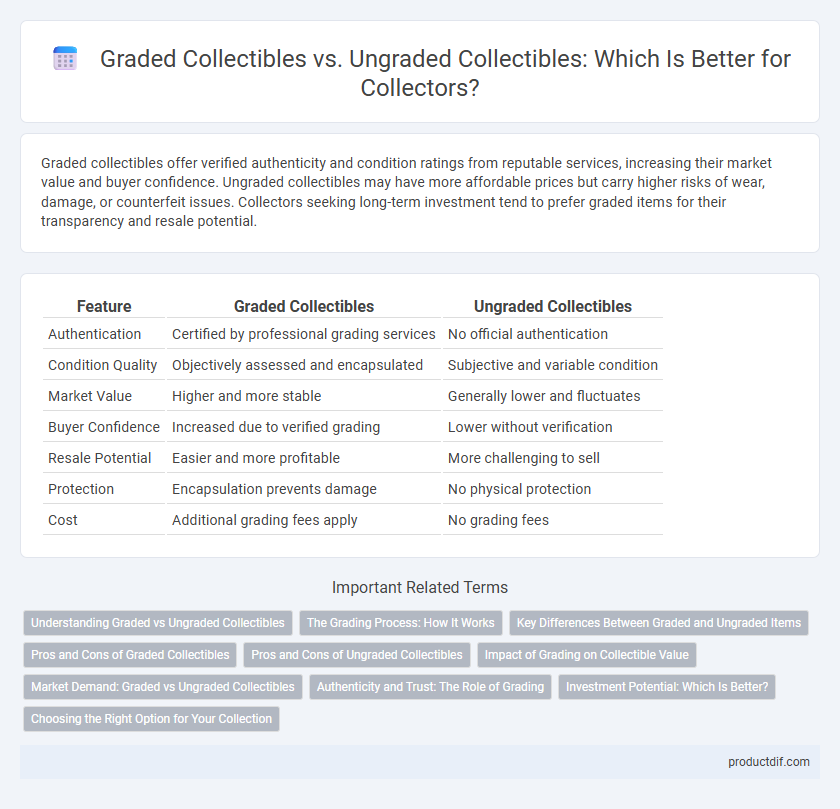

| Feature | Graded Collectibles | Ungraded Collectibles |

|---|---|---|

| Authentication | Certified by professional grading services | No official authentication |

| Condition Quality | Objectively assessed and encapsulated | Subjective and variable condition |

| Market Value | Higher and more stable | Generally lower and fluctuates |

| Buyer Confidence | Increased due to verified grading | Lower without verification |

| Resale Potential | Easier and more profitable | More challenging to sell |

| Protection | Encapsulation prevents damage | No physical protection |

| Cost | Additional grading fees apply | No grading fees |

Understanding Graded vs Ungraded Collectibles

Graded collectibles undergo professional evaluation based on condition, authenticity, and rarity, providing a standardized score that significantly influences market value and buyer confidence. Ungraded collectibles lack formal assessment, often leading to variable perceived worth and potential disputes over quality. Understanding these differences helps collectors make informed decisions by balancing investment security and purchase cost.

The Grading Process: How It Works

The grading process for collectibles involves an expert examination to assess condition, authenticity, and overall quality, resulting in a numerical or categorical grade. This grade is encapsulated in a tamper-evident holder, providing a standardized measure that boosts market confidence and resale value. Ungraded collectibles lack this professional evaluation, making their condition and authenticity subjective and potentially riskier for buyers and sellers.

Key Differences Between Graded and Ungraded Items

Graded collectibles undergo professional authentication and condition assessment, resulting in a standardized numerical grade that significantly impacts their market value and buyer confidence. Ungraded collectibles lack this official certification, making their authenticity and condition subjective and often less reliable for precise valuation. The key difference lies in the verified quality assurance provided by grading, which enhances liquidity and trust compared to ungraded items.

Pros and Cons of Graded Collectibles

Graded collectibles offer verified authenticity and condition, significantly enhancing market value and buyer confidence, especially in trading cards, coins, and comics. The grading process can protect items through encapsulation, reducing the risk of damage or tampering, but it often involves fees and turnaround time that might not be suitable for every collector. While graded items tend to sell faster and at higher prices, ungraded collectibles allow for immediate possession and flexibility in condition assessment without the constraints of standardized grading scales.

Pros and Cons of Ungraded Collectibles

Ungraded collectibles offer the advantage of lower initial costs, making them accessible to a wider range of collectors and allowing greater flexibility in negotiating prices. However, these items carry higher risks due to uncertain authenticity and condition, which can impact resale value and long-term investment potential. Collectors must rely heavily on personal expertise or third-party appraisals to assess ungraded collectibles accurately.

Impact of Grading on Collectible Value

Graded collectibles undergo professional evaluation that authenticates condition, significantly increasing their market value and buyer confidence. Ungraded collectibles lack this verification, often resulting in lower prices and uncertain quality. The grading process provides a standardized measure, making graded items more attractive to serious collectors and investors.

Market Demand: Graded vs Ungraded Collectibles

Graded collectibles consistently experience higher market demand due to verified authenticity and condition, making them more attractive to serious collectors and investors. Ungraded collectibles often face price volatility and reduced buyer confidence, limiting their market liquidity and overall value. The grading process significantly enhances market trust, driving higher sales and better returns.

Authenticity and Trust: The Role of Grading

Graded collectibles provide a verified assessment of authenticity and condition, enhancing buyer confidence and market value compared to ungraded items. Professional grading services employ standardized criteria and expert evaluation to reduce counterfeit risk and establish trust in transactions. The documented grade serves as a reliable certification, making graded collectibles more desirable for collectors and investors alike.

Investment Potential: Which Is Better?

Graded collectibles offer higher investment potential due to their verified authenticity, condition assessment, and market trust, which significantly increase resale value and liquidity. Ungraded collectibles may have lower initial costs but carry risks of misrepresentation and fluctuate in value, making them less reliable for long-term investment. Investors seeking stability and greater returns typically prioritize graded collectibles for their transparency and standardized market evaluation.

Choosing the Right Option for Your Collection

Graded collectibles offer verified authenticity and condition ratings, enhancing their market value and ease of resale compared to ungraded items. However, ungraded collectibles provide flexibility for personal inspection and often lower upfront costs, appealing to enthusiasts focused on unique or rare finds. Assessing your collecting goals, budget, and long-term investment strategy helps determine whether graded or ungraded items best complement your collection.

Graded Collectibles vs Ungraded Collectibles Infographic

productdif.com

productdif.com