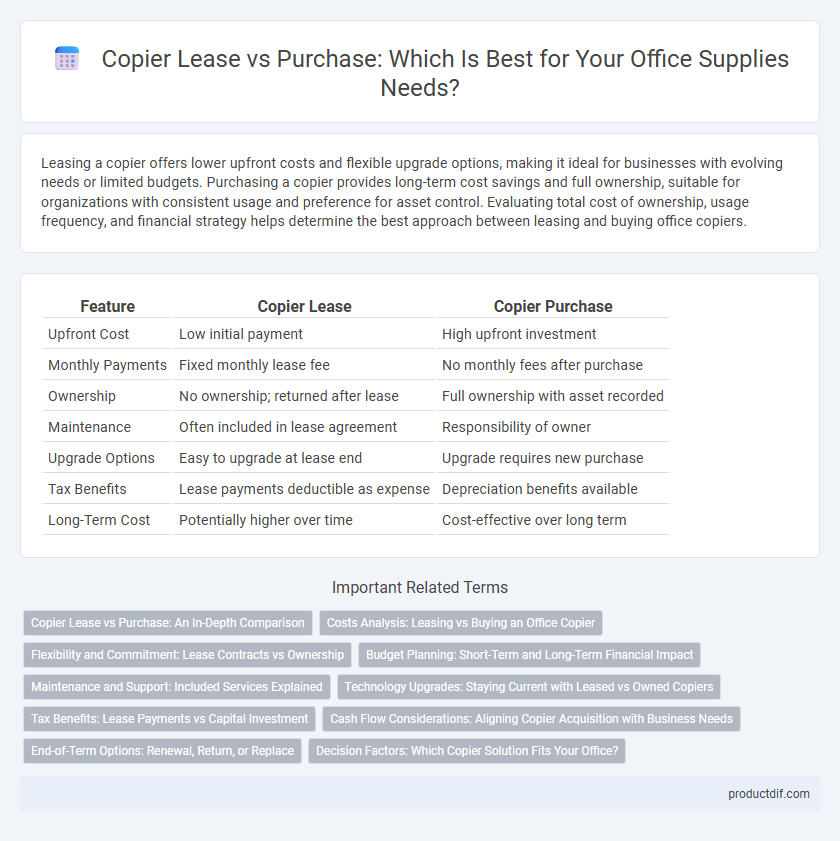

Leasing a copier offers lower upfront costs and flexible upgrade options, making it ideal for businesses with evolving needs or limited budgets. Purchasing a copier provides long-term cost savings and full ownership, suitable for organizations with consistent usage and preference for asset control. Evaluating total cost of ownership, usage frequency, and financial strategy helps determine the best approach between leasing and buying office copiers.

Table of Comparison

| Feature | Copier Lease | Copier Purchase |

|---|---|---|

| Upfront Cost | Low initial payment | High upfront investment |

| Monthly Payments | Fixed monthly lease fee | No monthly fees after purchase |

| Ownership | No ownership; returned after lease | Full ownership with asset recorded |

| Maintenance | Often included in lease agreement | Responsibility of owner |

| Upgrade Options | Easy to upgrade at lease end | Upgrade requires new purchase |

| Tax Benefits | Lease payments deductible as expense | Depreciation benefits available |

| Long-Term Cost | Potentially higher over time | Cost-effective over long term |

Copier Lease vs Purchase: An In-Depth Comparison

Leasing a copier often reduces upfront costs and includes maintenance services, making it ideal for businesses seeking predictable monthly expenses and equipment upgrades. Purchasing a copier requires a larger initial investment but offers long-term cost benefits and full ownership, which can be advantageous for companies with stable or high-volume printing needs. Evaluating total cost of ownership, usage frequency, and technological obsolescence is essential to determine whether leasing or purchasing aligns best with your office supply needs.

Costs Analysis: Leasing vs Buying an Office Copier

Leasing an office copier typically involves lower upfront costs and predictable monthly payments, which can help manage cash flow and budget planning. Purchasing a copier requires a significant initial investment but may offer long-term savings by eliminating recurring lease fees and allowing for asset depreciation benefits. Cost analysis should also factor in maintenance expenses, technology upgrades, and potential tax advantages for businesses.

Flexibility and Commitment: Lease Contracts vs Ownership

Leasing a copier offers greater flexibility through shorter contract terms and easier upgrades to newer models, accommodating evolving business needs without long-term commitment. Purchasing a copier requires a significant upfront investment and long-term ownership responsibility, limiting adaptability but providing full control over the equipment. Businesses prioritizing budget predictability and technology access often prefer leasing, while those valuing asset ownership and maximum usage may opt to purchase.

Budget Planning: Short-Term and Long-Term Financial Impact

Leasing a copier often requires lower upfront costs, benefiting short-term budget planning by preserving cash flow, while purchases involve significant initial investment but reduce long-term expenses through ownership. Lease agreements provide predictable monthly payments that simplify financial forecasting, whereas purchased copiers may incur varying maintenance and depreciation costs affecting long-term budgeting. Evaluating total cost of ownership and cash flow impact is essential for aligning copier acquisition with the company's financial strategy.

Maintenance and Support: Included Services Explained

Copier leases often include comprehensive maintenance and support services, covering repairs, regular servicing, and parts replacement, which reduce unexpected costs and downtime. Purchasing a copier usually requires separate maintenance contracts or pay-per-service arrangements, potentially increasing overall operational expenses. Businesses prioritizing consistent support may find leasing more cost-effective, while ownership offers control but with variable maintenance responsibilities.

Technology Upgrades: Staying Current with Leased vs Owned Copiers

Leasing copiers ensures access to the latest technology upgrades through regular contract renewals, eliminating the risk of outdated equipment impacting office productivity. Owned copiers often become obsolete as newer models with advanced features emerge, requiring costly replacements or retrofits. Technology refresh cycles are more manageable with leases, providing businesses with scalable solutions aligned with evolving office demands.

Tax Benefits: Lease Payments vs Capital Investment

Leasing a copier allows businesses to deduct lease payments as a regular operating expense, providing immediate tax benefits and improved cash flow management. Purchasing a copier requires capital investment, where the asset is capitalized and depreciated over time, potentially leading to slower tax deductions compared to lease payments. Evaluating tax benefits depends on company financial strategies, with leasing often favored for maximizing short-term expense deductions and purchasing beneficial for long-term asset ownership and depreciation.

Cash Flow Considerations: Aligning Copier Acquisition with Business Needs

Leasing a copier preserves cash flow by spreading payments over time, reducing upfront costs and freeing capital for other business expenses. Purchasing requires a larger initial investment but eliminates ongoing lease payments and may offer tax advantages through depreciation. Aligning copier acquisition with cash flow needs ensures operational efficiency and financial stability in office supply management.

End-of-Term Options: Renewal, Return, or Replace

Copier lease end-of-term options include renewal, return, or replacement, allowing businesses to choose based on operational needs and budget constraints. Renewal offers continuity with updated terms, return facilitates upgrading to newer models without additional ownership costs, and replacement provides the latest technology while potentially resetting lease terms. Understanding these options helps optimize office supply management by balancing cost efficiency and equipment performance.

Decision Factors: Which Copier Solution Fits Your Office?

Choosing between copier lease and purchase depends on budget flexibility, usage frequency, and maintenance preferences; leasing offers lower upfront costs and regular upgrades ideal for rapidly growing businesses, while purchasing is cost-effective for long-term, high-volume use. Consider total cost of ownership, including service contracts, downtime risks, and equipment depreciation, to align with your office's operational demands. Analyze cash flow impact, tax implications, and scalability needs to determine the optimal copier solution for your specific office environment.

Copier Lease vs Purchase Infographic

productdif.com

productdif.com